Covid-19 Special NRS Pay Point of Sale Pricing: $699 (REG. $1299)

Covid-19 Special NRS Pay Point of Sale Pricing: $699 (REG. $1299)

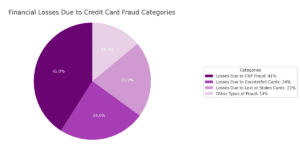

Credit card fraud is a growing issue that retailers can’t ignore. According to a report by the National Retail Federation, credit card crime costs retailers billions of dollars each year. With the surge in online shopping and contactless payments, fraud detection has become more challenging, resulting in financial losses and damaging retailers’ reputations and customer trust.

Moreover, the consequences of falling victim to card misuse extend beyond immediate financial loss. It can lead to a long and complicated investigation, increased operational costs for implementing billing scam protection, and a potential price rise for consumers. Therefore, understanding what credit card fraud is and how to combat it effectively is not just a security measure but a business imperative for retailers.

Unfortunately, this type of crime is not new to the retail industry. It’s a hot target for cybercriminals due to the high volume of payment transactions. Recent statistics show increased data breaches affecting major retailers like Target and Home Depot. These breaches have led to card fraud reports involving millions of stolen records. The pandemic has further complicated the detection as more transactions move online.

| Type of Fraud | Description | Example |

| CNP Fraud | Occurs when stolen credit card information is used for online or phone transactions. | Unauthorized online shopping purchases. |

| Counterfeit Cards | Produced using stolen credit card info for in-store purchases. | Fake card used at a retail store. |

| Lost or Stolen Cards | Used for unauthorized purchases. | Stolen card used to buy electronics. |

Card-not-present (CNP) fraud is a type of crime that’s becoming increasingly prevalent with the rise of online shopping. In this scenario, criminals use stolen credit card information to purchase online or over the phone. Because the card isn’t physically present during the transaction, traditional verification methods like signatures or PINs could be more effective. This makes detection particularly challenging for CNP transactions, requiring retailers to employ advanced credit card protection measures like two-factor authentication or behavioral analytics.

Counterfeit cards are another common form of credit card crime that retailers must watch out for. Criminals produce fake cards using stolen information and use them for in-store purchases. These cards can look incredibly authentic, making it difficult for employees to spot them during transactions. In this case, the prevention often involves using EMV chip technology, which generates a unique code for each transaction, making it harder for counterfeit cards to be used successfully.

Lost or stolen cards represent a more straightforward but equally damaging form of financial deception. In these cases, criminals use lost or stolen cards to make unauthorized purchases until the card is reported and deactivated. Retailers can mitigate the risks by implementing protection measures like requiring photo ID for large transactions or using payment processors that flag suspicious activity. How to report credit card fraud quickly is crucial in these situations to minimize damage.

Criminals use various methods to steal credit card information:

Skimming is a sneaky way criminals steal credit card information. They install small devices, known as skimmers, on ATMs or payment terminals. When a customer swipes their card, the skimmer captures the card’s data. This method is hazardous because it’s hard to detect; the devices are often well-disguised to blend in with the machine. Retailers can combat skimming by regularly inspecting their payment terminals and upgrading to more secure, tamper-evident models as part of their credit card fraud prevention strategy.

Phishing scams are another common tactic for credit card electronic pickpocketing. Criminals send out fake emails or text messages that appear to come from legitimate organizations. These messages often ask for sensitive information like credit card numbers or passwords. Falling for a phishing scam can lead to unauthorized transaction reports and a complicated financial deception investigation. Retailers should educate their employees and customers about the dangers of phishing and how to recognize such scams to enhance payment security.

Hacking involves cyberattacks on corporate networks to steal large volumes of data, including credit card information. These attacks can be highly sophisticated, exploiting vulnerabilities in a retailer’s security system. Once inside, hackers can access and download a treasure trove of sensitive data. Credit card fraud detection in the case of hacking involves robust cybersecurity measures, regular security audits, and compliance with PCI DSS standards to safeguard against data breaches

Detecting financial misconduct involves training employees to recognize signs such as:

One of the first red flags for detecting card fraud is unusual purchasing behavior. This could be a customer buying an unusually large quantity of a single item or making multiple purchases in quick succession. Similarly, numerous high-value transactions can also be a sign of fraudulent activity. These transactions far exceed the average purchase amount typically seen in the store. Retailers should set up internal alerts for such transactions as part of their card fraud protection measures. Employees should be trained to spot these signs and possibly hold the transaction until additional verification can be completed.

Another common sign is a series of declined transactions followed by one approved. This pattern often indicates that a scammer is testing multiple cards to find one that works, and it should immediately trigger a card misuse report. Additionally, purchases made outside regular business hours can be suspicious, especially if they involve high-value items.

Retailers can use payment processors with built-in fraud detection algorithms to flag such transactions automatically. Training employees to recognize these signs is crucial for reporting credit card fraud effectively and minimizing potential damage. https://nrsplus.com/press-release/

| Month | Activity |

| January | Initial Security Audit |

| February | – |

| March | Security Update |

| April | – |

| May | Mid-Year Security Audit |

| June | Security Update |

| July | – |

| August | Security Update |

| September | End of Q3 Security Audit |

| October | Security Update |

| November | – |

| December | Year-End Security Audit and Update |

Carding fraud prevention involves multiple layers of security:

Two-factor authentication: Requires two forms of ID before completing a transaction.

EMV chip technology is a cornerstone of modern payment scam prevention. Unlike traditional magnetic stripe cards, EMV chips generate a unique transaction code for each purchase. This makes it nearly impossible for scammers to use skimmed or cloned card data for future transactions. Retailers who adopt EMV technology enhance their financial deception safeguards and align themselves with global payment standards, reducing liability in the event of financial misconduct.

Tokenization is another effective measure for credit card fraud prevention. This technology replaces sensitive card information with a unique digital “token.” Even if a hacker gains access to the token, it’s only useful with the original data it represents. Tokenization is particularly useful for online retailers and those who store customer payment information for future transactions. It adds an extra layer of security, making it a valuable part of any CC scam protection strategy.

Encryption is essential for securing data both in transit and at rest. By converting cardholder data into a code, encryption makes it unreadable to everyone with the proper decryption key. This is crucial for protecting information as it travels over networks or sits in storage. Retailers should ensure that their payment processors support strong encryption standards as part of a comprehensive payment scam prevention approach.

Encryption is essential for securing data both in transit and at rest. By converting cardholder data into a code, encryption makes it unreadable to everyone with the proper decryption key. This is crucial for protecting information as it travels over networks or sits in storage. Retailers should ensure that their payment processors support strong encryption standards as part of a comprehensive payment scam prevention approach.

Two-factor authentication (2FA) adds an extra layer of security by requiring customers to provide two forms of identification before completing a transaction. This could be something they know, like a password, and something they have, like a mobile device.

2FA is especially useful for online transactions where detecting unauthorized payments can be more challenging. It’s an effective way to verify the customer’s identity and significantly reduce the risk of financial deception.

Effective fraud reporting begins at the frontline with well-trained employees. Retailers should invest in regular training programs that educate staff on the signs of unauthorized transactions and the procedures for reporting it. This training should be backed by strict policies compliant with the Payment Card Industry Data Security Standard (PCI DSS).

These policies outline how to handle sensitive customer data securely, from the point of transaction to storage. Retailers can create a first line of defense in their credit card fraud prevention efforts by equipping employees with the proper knowledge and tools.

When it comes to how to prevent credit card fraud, customer verification plays a pivotal role. Retailers should implement robust verification processes like ID checks or phone verification, especially for high-value transactions. This extra step can deter cheaters who have access to card information but not additional personal details.

By requiring this second layer of verification, retailers add another hurdle for criminals to clear, making it more challenging for them to complete a fraudulent transaction. This protects the business and enhances customer trust in the retailer’s payment protection measures.

Regular security audits are necessary for any retailer serious about scam prevention. These audits help identify vulnerabilities in the payment system that card swindlers could exploit. But it doesn’t stop there.

Keeping systems updated with the latest security patches is equally crucial. Outdated software can be an easy target for hackers, leading to potential credit card fraud investigations and financial losses. By staying on top of security audits and system updates, retailers can fortify their defenses, making it increasingly difficult for criminals to penetrate their systems.

Navigating the complex landscape of credit card fraud prevention can be challenging, but retailers don’t have to go it alone. Several resources are available to help you strengthen your defenses and respond effectively if a billing scam occurs.

Payment Processors: Companies like National Retail Solutions offer built-in credit card fraud detection algorithms to flag suspicious transactions.

The stakes are high when it comes to credit card fraud punishment. Businesses face significant revenue loss, incur hefty legal fees, and suffer from negative publicity that can tarnish their reputation for years. It’s not just about Chase credit card fraud but all types of financial scams that can hit a retailer.

That’s why being proactive in implementing the above-mentioned prevention measures is not just advisable—it’s essential. By taking these steps, retailers protect their bottom line and build a fortress of trust with their customers, making it a win-win situation for everyone involved.

Preventing credit card crime is not a one-time task; it’s an ongoing effort that demands constant vigilance. Retailers who are committed to card con protection are not just securing their immediate transactions but are also building a long-term shield against potential threats.

This involves implementing robust security measures and training staff on how to report payment scams effectively. Quick and accurate reporting can make all the difference in stopping a scam in its tracks and preventing further damage.

In the long run, these proactive steps do more than just prevent financial loss. They also serve to strengthen a retailer’s reputation in the industry. Customers are more likely to shop at stores where they feel their information is safe. By dedicating time and resources to credit card fraud protection, retailers are making a smart investment in their future, safeguarding their revenue and brand integrity.

CC Fraud is an illegal activity where someone gains unauthorized access to another person’s credit card information and uses it for personal gain. For example, a scammer might steal your credit card details and make online purchases without your knowledge.

Scammers are often caught through advanced security measures and vigilant monitoring. Many credit card companies use algorithms that flag unusual purchasing behavior, such as high-value transactions or multiple attempts within a short period. Retailers also play a role by implementing scam detection measures like ID checks, two-factor authentication, and employee training to identify suspicious activities.

Countries with less stringent regulations and enforcement are generally considered high risk for card scams. However, it’s a global issue that can happen anywhere. According to some reports, countries like Brazil, Mexico, and South Africa have higher rates of scams than others. But it’s essential to note that con artists often operate across borders, making it a worldwide concern.