Covid-19 Special NRS Pay Point of Sale Pricing: $699 (REG. $1299)

Covid-19 Special NRS Pay Point of Sale Pricing: $699 (REG. $1299)

While it may be true that businesses that only accept cash save money on credit card fees, they are losing out on the many benefits of accepting credit card payments. Credit cards have become the most popular payment method for customers and will continue to stay that way in the coming years. This is because credit cards offer customers convenience, security, and rewards that cash does not. Store owners may be hesitant to accept credit cards due to the processing fees, hidden fees, long-term contracts, and impact on their bottom line.

However, companies like National Retail Solutions can help businesses easily process credit cards without the hassle of long-term contracts or hidden fees. This article will explain why merchants should accept credit cards, what is involved in the process, and what we offer.

Credit cards provide numerous advantages not only to merchants but also to customers. For example, by accepting credit cards, merchants can get paid faster, encouraging impulse purchases and making their operations more secure and convenient. In addition, customers can also enjoy the flexibility and convenience of paying for items with a credit card. Rather than rummaging through their wallets and purses to look for loose change, customers can simply tap, swipe, dip, or pay through a mobile app to pay for merchandise without the hassle.

Moreover, customers can take advantage of numerous benefits associated with credit cards, such as cashback rewards, airline miles, discounts, and fraud protection. There are no rewards with cash, and it is more likely to be stolen or misplaced. With credit cards, customers can easily call the credit card company when they lose a credit card, keep track of their spending, and have a more secure option to pay for merchandise.

With all this in mind, merchants may be conflicted about accepting credit cards and whether it is worth the investment. Here we will take a closer look at the many reasons why merchants should accept credit cards, as it is beneficial to them in the long run:

Credit cards provide numerous benefits, including the ability to track spending, dispute fraudulent purchases, and protect customers’ data from hackers. Whereas if customers use cash, they cannot track their spending or even get their money back if it is stolen. Similarly, if a merchant only accepts cash and there is a robbery, they cannot dispute it with the bank or get reimbursed, resulting in a financial loss. To avoid this, merchants can accept credit cards and transfer the money to their bank account, giving them more security and peace of mind. Credit cards are a more secure way for customers to pay for their items, a personal identification number (PIN), chip and signature, and encryption technology. These measures help give customers the security they need and ensure that their data isn’t compromised.

In today’s digital age, a cash-only business cannot compete with its counterparts, who accept digital payment options such as credit cards, online transfers, and mobile payment services. Especially since 80% of customers prefer using a credit card over cash. Customers would rather go to a store with more payment methods than one limiting their options.

Paying with a credit card is a simple and straightforward process involving taping, swiping, or inserting a credit card into the card reader. Customers can also pay for items using an app on their phone that carries their credit cards digitally, such as Apple Pay, Google Pay, Amazon Pay, etc. Customers paying with credit cards not only can speed up the checkout process but also help the business expand its consumer base, resulting in more revenue.

When customers pay with cash, there is no record of how much money they have spent. Rather, customers have to either manually input how much they spent through an app or keep paper receipts. Which is time-consuming and, in many cases, unreliable.

On the other hand, customers who use a credit card can track their spending by looking at their payment history, using their credit card’s mobile app, looking at receipts, and so on. Credit card companies that have an app for their customers can send notifications to their phones if a purchase has been made. This allows customers to track their spending better and prevents them from overspending unknowingly. Customers prefer to pay with a credit card when purchasing from a store because it is recorded on their credit transaction history, and they can get rewards such as cashback or loyalty points.

Using a credit card has many benefits, but one of the most important is building a credit history. Merchants and customers can both benefit from using credit cards because it can provide them with loans for whatever they need to help grow their businesses or purchase necessary items. Building a credit history can offer them more access to potential funds in the future as their creditworthiness increases.

Finally, credit cards give customers rewards that encourage them to use their cards when making purchases. Many credit card companies provide various rewards, such as cashback, airline points, sign-up bonuses, discounts, etc. There are many credit card companies to choose from, each of which can benefit any consumer based on their specific needs. For example, if a customer spends most of their money at grocery stores and gas stations, a credit card company caters to these purchases and provides cash back. There are also business credit cards available for store owners and entrepreneurs that offer rewards specifically tailored to their business needs.

There are numerous methods that a business can use to accept credit cards in their store. Accepting credit cards begins with choosing a processor and point-of-sale system, followed by determining which pieces of equipment a store owner may need to improve the checkout process. For example, they may need a card reader, POS terminal, a cash drawer and a printer for receipts, etc.

A credit card reader is a machine that decodes a customer’s credit card information from the microchip, magnetic stripe, etc. When a customer inserts or swipes their credit card, the credit card reader reads the data from the chip or magnetic stripe and sends it to the payment processor. It then collects the customers’ bank information, and the transaction will be approved if there is enough money on the card. The credit card processor will then notify the customer and send the information back to the employee to finish the sale.

While these machines are secure, it’s always important for store owners to ensure that they have a credit card reader that is capable of reading EMV chip cards. If a credit card reader has this function, it can prevent fraud by generating a new code for each customer transaction. This can make them less vulnerable to having their information stolen by hackers. It is vital to have this in the credit card reader to help protect customers and to give the store owners peace of mind that their financial information is secure.

If merchants want to further enhance their customers’ checkout experience, there are other components they should consider using. These components include a POS terminal with a barcode scanner, customer-facing screen, cash drawer, and receipt printer. Using these at a store can allow merchants to quickly and accurately scan items, process payments, and print receipts to make customer transactions as seamless as possible. Below, we will discuss why these are necessary for any marketplace to keep operations running smoothly and efficiently:

Store owners should now understand not only why credit card processing is important to have in their business but also the equipment that can help them improve their services. It is also vital for store owners to know how the process works and how they can avoid paying high transaction fees that can ultimately hurt their bottom line. Let’s go through the stages one by one for store owners to get a clear understanding of what the process is like:

The customer first inserts or swipes their card into the credit card processor. The processor collects the data from the card and transmits it to the credit card network. The credit card network then submits a request to the credit card issuer. The issuer reviews the card information: credit card number, expiration date, billing address, CVV, and payment amount.

The issuer then requests the payment from the customer’s bank. The bank looks over the information and approves the account and the funds available to make the payment. The bank will hold the funds in the customer’s account until the store owner’s point-of-sale system approves it.

The store owner’s point-of-sale system sends the approved authorization to the payment processor. The payment processor sends the information to the credit card company and then to the bank. The funds are transferred to the store owner’s account, which typically happens within 24 to 48 hours.

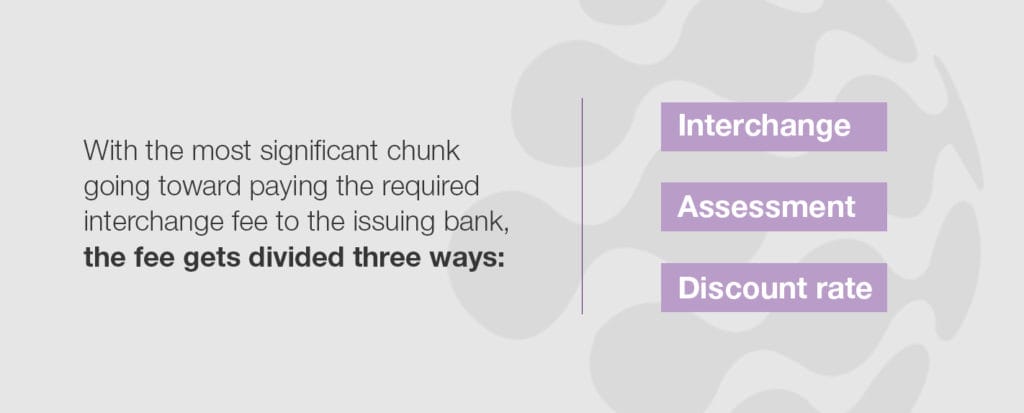

The transaction fees are deducted from store owners every time a customer pays for an item. These fees usually pay the banks and processors involved in the transaction and get divided into three ways. The most significant amount goes towards paying the interchange fees to the bank.

Processors will use one of these models to determine their fees.

When customers choose the wrong credit card processing company, they can be hit with hidden fees and markup fees that can hurt their bottom line. At NRS, we strive to be transparent and honest with our customers. We offer no hidden or markup fees or additional charges. That isn’t all, we also offer clear terms and conditions and a comprehensive customer support team that can help our customers understand all the features of our credit card processing service. We also have two pricing options for credit card processing so that merchants can choose the best fit for their business:

At NRS, we understand how important it is for small businesses to have an affordable credit card processor. So many credit card processing companies take advantage of small businesses, but not us. We want to give our customers everything they need to succeed and compete on a level playing field. Our credit card processors accept all payment methods, including EBT, eWIC, Apple Pay, Google Pay, and others. We also offer small businesses:

We want our customers to have the best experience possible. That is why we strive to provide the highest level of security, compatibility with our Point-of-Sale systems, and excellent customer service for all of your needs!

Credit card processing doesn’t have to be a hassle; with the all-in-one POS system from NRS, we offer merchants the best built-in software and hardware that gives merchants everything they need to effectively manage their business. We offer a thermal printer, barcode scanner, cash drawer, customer-facing screen, and credit card processing from NRS PAY. We have so many features for our customers to choose from, making it easy for merchants to find exactly what they need to suit their business. Our POS system software automatically updates merchants to the latest version to provide their customers with excellent service every time. To get started, request a free quote today.