Covid-19 Special NRS Pay Point of Sale Pricing: $699 (REG. $1299)

Covid-19 Special NRS Pay Point of Sale Pricing: $699 (REG. $1299)

Credit card transactions are processed through various platforms, including physical terminals, online payment gateways, and even mobile applications. When a customer swipes, dips, or taps their credit card, there are many players who are involved in the process of making the transaction authorized. It is important that merchants understand how credit card processing works, how they can avoid fees, and find the best credit card processor for all their business needs.

In this article, we will explain how it works and how merchants can grow their business in a competitive retail market.

On the surface, a credit card transaction may appear to be a simple, straightforward process. However, a series of events must occur in order for a transaction to be completed. When a customer dips, swipes, or taps their credit card, the transaction is processed, verified, accepted, or declined through a complex network of banks, payment networks, and merchants. Nonetheless, merchants must understand all of the key players and their roles to ensure seamless, secure, and error-free transactions.

Cardholder— Most people own a credit card, so customers are probably already aware of the responsibilities of having one. Holders can use their cards to purchase products and services from most merchants.

Merchant — Any business that sells goods and services is a merchant. But, when it comes to the credit card industry, we want to focus on those who consider credit cards an acceptable form of payment. By opening a merchant account with a credit card processor, they can accept debit and credit cards for any goods and services they may be providing.

Acquiring bank — An acquiring bank, or the merchant’s bank, is a bank that registers with a card association such as Visa and Mastercard. The acquiring bank plays a role in accepting credit card transactions on behalf of the merchants. They manage merchants’ accounts, overseeing activity, request authorization, deposit transactions, and chargeback responses.

Issuing bank — As its name suggests, the issuing bank is the one that distributes credit cards to consumers. Like acquiring banks, they also are members of significant card associations. Issuing banks must pay acquiring banks for the purchases card users make. The cardholder then repays the issuing bank under the terms they signed when taking on the responsibility of obtaining a credit card. The issuing bank takes a more hands-on role than an acquiring bank and does most of the work themselves.

Card associations — Visa, Mastercard, and other card associations are not responsible for issuing cards or maintaining merchant accounts. Instead, they oversee financial institutions, ISOs, and membership service providers by making sure credit processing and electronic payments are working as expected.

Each one of these players plays a key role in ensuring that the transaction is secure and safe against fraud. The transaction process goes as follows, the cardholder’s information is transferred to the acquiring bank, which then transmits it to the credit card company and then to the cardholder’s bank. From there, the information will be determined to see if it can be approved or denied and will be sent back to the merchant.

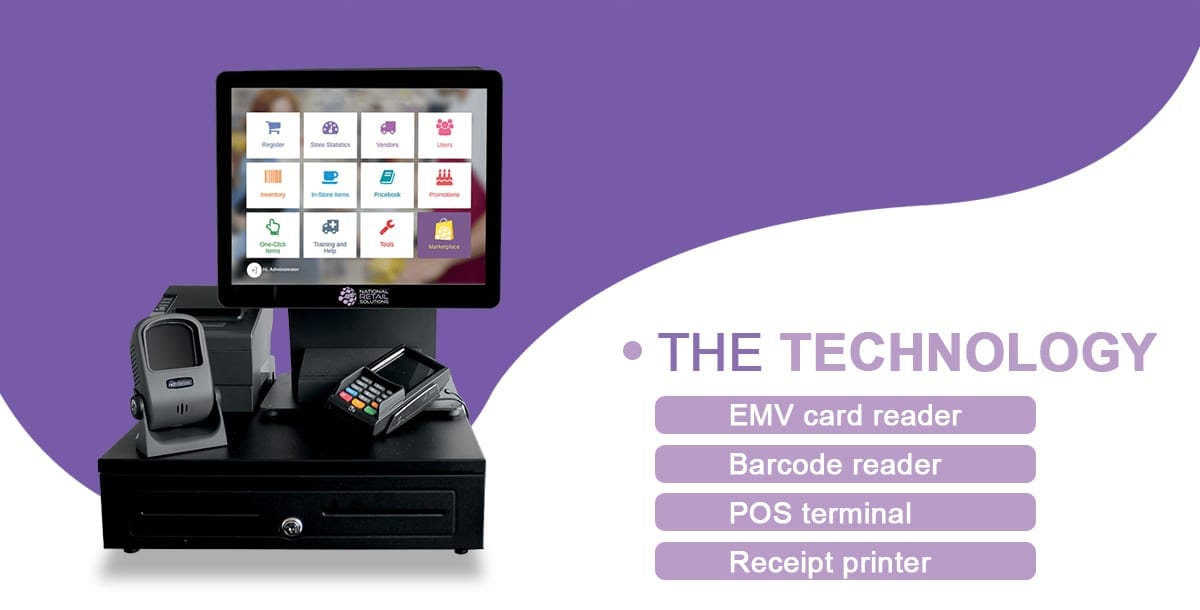

Now if merchants want their transactions to run smoothly, there are different pieces of equipment that can help streamline their operations:

POS-integrated EMV card reader — EMV chip cards are a piece of technology that has rapidly increased in prevalence nationwide over the last few years. The carp patent terminal ideally communicates directly with the retailer’s point of sale system, if the store has a register at the checkout counter. Due to the increasingly innovative ways cybercriminals conduct widespread data breaches and create counterfeit cards, card issuers have developed new methods to protect consumers from falling victim to fraud or stealing their hard-earned savings. This step forward has caused merchants to add new in-store technology and credit card machines that support EMV chip cards.

Point of sale terminal — A POS machine is the hub that connects all the other aspects of an in-store system. The most powerful POS machines include a touchscreen that allows for convenient use by employees. The screen faces employees, enabling them to use on-screen buttons to navigate through options during checkout. Some POS’ even include a customer screen that shows details about items, prices, discounts, and advertisements. The credit card reader connects to the POS for a smooth checkout process.

POS barcode reader — Barcode scanners are electronic devices that read barcodes for in-store products. A barcode scanner used in conjunction with a point-of-sale (POS) system increases efficiency by speeding up the checkout process, improves accuracy, and eliminates the possibility of a manually entered error in a system. Handheld barcode readers provide more ease of use and can reach barcodes in challenging places. Finding the right barcode scanner that suits your needs will help you manage prices and transfer data better than ever before.

Receipt printer — Modern digital printers that generate receipts use thermal technology that produces an image by heating special heat-activated paper. They can achieve different colors by heating the paper at different temperatures. Thermal receipt printers work seamlessly with POS systems and provide numerous benefits to any business owner. Not only do they have a faster printing speed, but also require less maintenance than regular printers. Since they have fewer moving parts, they are less likely to break or jam. Keeping maintenance costs low is a vital aspect of a successful establishment.

Cash drawer — Cash drawers store currency and other valuables that work with the rest of the POS system. They have improved by leaps and bounds and now can track sales and recognize when one happens. To prevent theft, they require individual instruction to open. A cash drawer should also be sturdy and immune to breakage to prevent criminals from easily prying the locking components open and stealing what is inside.

Now that we understand all the hardware and roles within credit card processing, how does credit card processing work?

Step 1: Authorization — Once the customer is ready to checkout and wants to use their credit card, they must swipe or insert their card in the merchant’s machine. Once the merchant’s acquiring bank has approved the transaction, they collect the payment information physically using an in-store credit card reader or an online system if the customer is shopping online.

Next, the information gets sent to the card network, such as Visa or Mastercard, which acts as a middleman between the customer and their bank.

Step 2: Authentication — Once the consumer’s preferred bank receives the request, they ensure the purchase is not fraudulent and that the customer has sufficient funds to complete the payment. Banks can typically detect issues, including insufficient funds, maximized credit limit, or a non-authorized user. Once they have checked that the transaction is valid and secure, they send the information back to the payment processor and then to the credit card reader or terminal.

But, what exactly happens when a credit card transaction gets declined?

A POS terminal can sometimes provide an explanation for why a transaction was declined. Other times, only the credit card company can pinpoint the issue. These are the most common reasons for a declined card:

Step 3: Clearing and Settlement — Even with an approved transaction, the funds do not leave the cardholder’s possession quite yet. Over the next few days, the credit card company and merchant take steps to ensure the process complies with approved procedures. The charges are sent in batches to the cardholder’s acquiring bank, which will appear on their monthly credit card statement at the end of a business day.

The processor then routes the merchant-provided information directly to the credit card company, where settlement occurs. The approved transactions get forwarded to the issuing banks of each customer, and the funds then get officially transferred after deducting fees. The fees go to the banks and processors that made the transactions possible, and the percentage gets deducted from the merchant’s account. After this process is complete and the transaction information appears on the customer’s statement, the credit card processing cycle concludes.

Today, customers expect stores to offer the utmost level of convenience. Merchants who refuse electronic payment in their establishments or online stores will almost certainly suffer upset customers and missed sales opportunities. However, in many scenarios, merchants require spending a minimum amount to allow the use of a debit or credit card. While customers may think this is just a ploy to get you to dish out more of your hard-earned cash, there is more to it than that. Unless they are utilizing a cash discount program, merchants pay a fee to be able to accept credit card payments.

To compensate for these charges, they often require a minimum spending amount, markup prices, or seek the least expensive credit card processing rates to absorb these costs. Credit card processing rates vary depending on the medium the merchant is using to sell their products or services. These mediums most commonly include retail, Ecommerce, or phone sales. The rates occur in several ways, which include flat fees, volume-based fees, or per-transaction fees. There are two major costs of credit card processing: merchant discount rate and chargebacks.

Merchant processing rates — If a merchant accepts credit card payments, the credit card processing company takes a percentage of sales for their service. Fees for retail stores can range from 2 to 3% of the total purchase price, while online stores can be pricier. Several elements comprise these prices. An interchange fee, a fixed fee, and markups.

Chargebacks — If customers want to dispute a charge on their billing statement they believe is unwarranted, they reserve the right to do so within 60 days of the settlement date. If an issuing bank receives a valid complaint from one of their customers, the merchant charges between $10 and $50 as a retrieval request. The merchant has a specified amount of time to respond to these requests. If the merchant ignores the notice or does not act in time, they can suffer even more fees.

However, new methods are being developed to assist merchants in overcoming the challenges associated with accepting credit and debit cards:

Cash Discount Program — Cash discount programs offer bonuses to customers who pay with cash or check. This program offsets credit card transaction fees to the customers and has shown great success regardless of the industry in which it’s utilized. While there is no way to zero out credit card fees, you can avoid paying fees by passing the additional costs to the consumer and rewarding those who use cash payment methods.

If you are a business owner seeking a smarter way to handle credit or debit card transactions, National Retail Solutions is a one-stop shop for everything you need to grow your business in a competitive retail market. We offer a network of services and packages to make the transaction process as easy for the merchant and the customer. Our systems work with all major credit cards, including:

We also allow the use of other means of transactions, such as:

NRS offers two different low-rate options, including a simple flat rate that does not leave you guessing what the final payment price will be, and custom rate options for businesses that process over $10,000 a month in credit card transactions. We work to save you money and find the best possible option for your particular operation. Deciding to go with NRS provides additional benefits. A three-year agreement will provide you with a free credit card reader as an added value and a thank you. Credit card processing for small businesses does not need to be a headache. If you want to see what specifically NRS can do for you, a free quote is just a click away.

Direct credit card processing from NRS Pay works with your NRS systems to provide a comprehensive payment processing solution. In addition to the benefits listed above, NRS Pay offers these advantages and more:

NRS Pay also integrates with POS from National Retail Solutions (NRS).

NRS Pay also integrates with POS from National Retail Solutions (NRS).A National Retail Solutions (NRS) POS system includes all the retail solutions you’ll need to grow your business, with the following hardware:

In addition to hardware, the software that comes with NRS’ POS system makes it easy to monitor your business expenses and customers’ purchasing behavior to provide insight to stay ahead of your competitors. Some of the features include:

These features make NRS’ retail solutions the ultimate store management tool. To learn more about the benefits of the National Retail Solutions POS+ system, ask for a free quote today!